The story thus far

In 2017, we realised as a business that we needed to change the way investments are done. When we listened to advisers, it was clear that several concerns and hurdles were making your life unnecessarily complicated.

To allow you to be the wealth manager of the future, things had to change. There was simply too much paperwork, too much wasted time, and the industry was struggling to embrace being digital. So, we set out to build something new. Purpose Built. Adviser Inspired.

A platform that was digital-first, future-proof proof and real-time-focused, to save you time so that you can do what you do best: advise clients.

Are we a brand-new business?

No, we are not. We are wholly owned by STANLIB, which is now, in turn, wholly owned by the Standard Bank Group. That makes us the centre of excellence for retail investments for the Group.

Our team has been in the investment administration business for more than two decades, and we are now simply applying that experience digitally on a future-fit platform.

What is the Elevate Programme?

To ensure your clients benefit from the specialised capabilities of the Group while remaining part of a cohesive, integrated whole, the Standard Bank Group is moving the administration of all investments from the STANLIB Platform onto the purpose-built specialist INN8 Investment Platform over the next 12 to 18 months.

We are completing the move in structured tranches and have completed the first tranche successfully in May 2025. The second tranche is happening later in the year, and the final group will be moving across in early 2026. Advisers in Tranche 2 should have already received email communication from STANLIB directly about the move.

We will begin communicating with the final tranche later in the year. We have prepared a set of detailed frequently asked questions (FAQs), which can be accessed on the CPD Portal by clicking here. If you have not registered for the CPD Portal yet, this PDF explains the process on how to register and get access.

What does Elevate mean for you, the adviser?

One of the core values of the INN8 Investment Platform is to put you and your clients at the centre of everything we do. While change is inevitable and can sometimes be challenging, moving to a purpose-built investment platform means your business is geared for the future and your client’s investment journey is future-proof. This is a necessary change to ensure sustainability for you and your business as the financial services industry evolves and moves into the future.

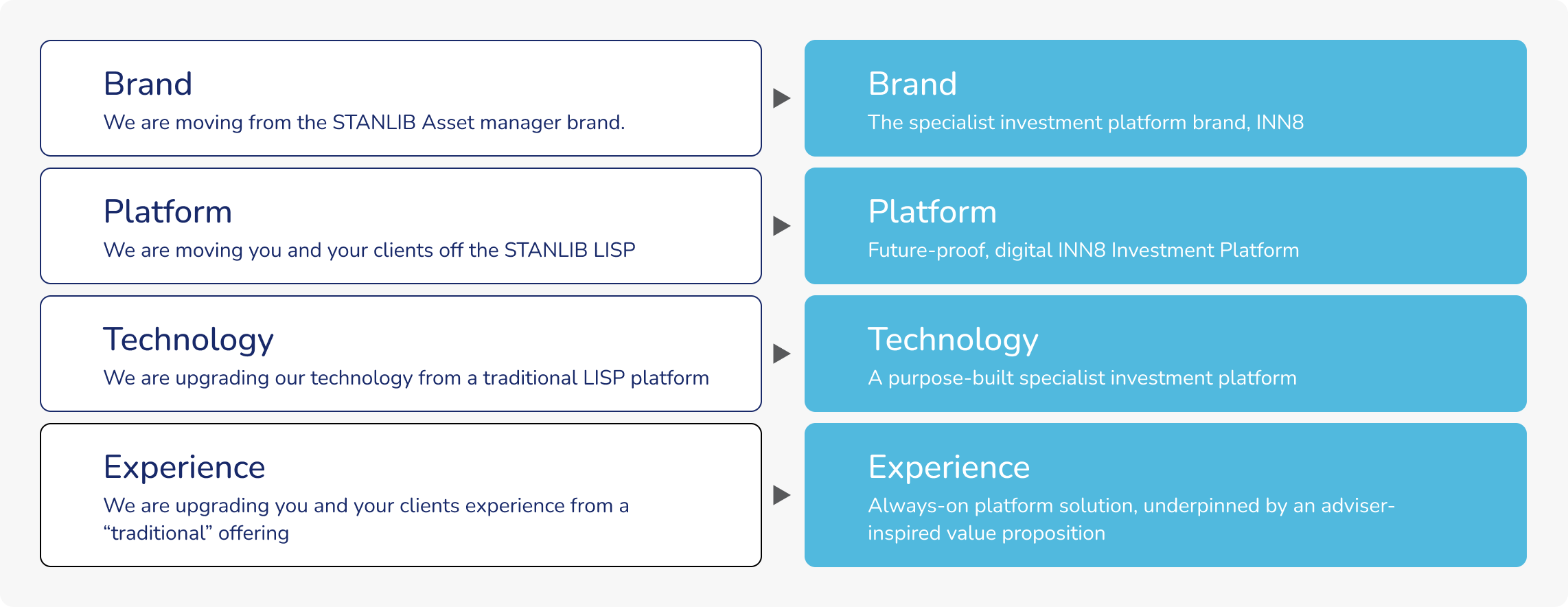

In short, the following is what will change:

How do you, as the adviser, benefit?

First and foremost, the INN8 Investment Platform puts you and your clients at the heart of everything we do. We understand that you have a trusted relationship with your clients, and we aim to strengthen this by giving you access to a digital-first investment platform, supported by efficient processes and servicing.

After the move to the INN8 Investment Platform, you will experience:

Seamless digital onboarding

Fully digital processes enable quick, paperless onboarding, allowing you to efficiently onboard clients and manage investments.

Future-ready technology

Intuitive, adviser-inspired tools ensure compliance, simplify fee structures, and support evolving regulatory requirements.

Comprehensive investment options

Access to clean-class funds, open architecture, multiple model portfolio functionality, and the ability to blend assets within a single account provides flexibility for tailored strategies.

Real-time oversight

Instruction Tracker tools and dashboards give you 24/7 visibility into your client journeys, accounts, and transactions.

Simplified administration

Features like the Product Cash Account and real-time top-ups reduce administrative burden.

Enhanced client communication

You can generate co-branded reports and provide clients with transparent, on-demand insights into their investments.

Dedicated support

A responsive service team and a dedicated key account manager ensure you receive hands-on support and quick resolutions to queries.

Efficiency in portfolio management

Tools for rebalancing, bulk switching, and centralised investment propositions streamline management for Discretionary Fund Managers (DFMs).

What are the benefits to your client?

Your clients will benefit from:

- Enhanced visibility:

Clients gain 24/7 access to their investments through the platform, providing greater control and transparency.

- Simplified tax management:

Efficient tax reporting tools help them prepare for tax season with ease and even plan proactively for Capital Gains Tax.

- Freedom of investment choice:

The platform allows you to tailor investment strategies, offering access to standalone funds, multiple model portfolios, or a combination, based on the individual goals of your clients.

- Flexibility and quick access:

Your clients can adapt their investments swiftly to match changing financial goals, with minimal delays or restrictions on accessing their funds.

- Family linking:

Your clients can benefit from reduced administration fees when linked family members’ investment values are aggregated

Do all advisers and clients have to move?

Over the course of the next 12 to 18 months, the administration of all client accounts will be moved from the STANLIB LISP on to the INN8 Investment Platform, with the STANLIB LISP scheduled to be decommissioned as a technology platform by the end of Q1 2026.

How are we communicating with you and your clients?

There will be various phases of communication where we make sure to keep you and your client informed every step of the way. The phases stay the same for each of the tranches. One important principle is that we will always send you, as the adviser, a heads-up first, before communicating with your client.

Typically, around three months before the move, this confirms previous engagements and introduces Elevate to clients who have not heard about it before.

Around six weeks before the move, this confirms previous engagements and informs advisers that all new client business needs to be placed on the INN8 Investment Platform going forward.

A month before the move, this is the first official notification of the date for the move and precedes the move by 30 days.

A series of communications to inform advisers and clients of the freeze period and what it entails.

Notification that the move was successful.

Let’s Elevate your business

Elevate is more than a platform change; it is a deliberate step towards future-proofing your practice and your clients’ investment journeys. As always, we’re here to support you through every phase, so you can focus on what matters most: building lasting relationships and guiding your clients with confidence.

The story thus far

In 2017, we recognised that the world of investments needed to change. By listening closely to financial advisers, we uncovered many challenges that were making things harder than they needed to be. To shape the future of wealth management, we set out to do things differently.

There was simply too much paperwork, too many delays, and the industry was slow to embrace the benefits of going digital. So, we set out to build something new — a platform designed to be digital-first, future-ready and focused on real-time investing. This means more time and freedom for your adviser to do what they do best: guide you on your financial journey.

Are we a brand-new business?

Not at all. We’re part of STANLIB, which is inturn wholly owned by the Standard Bank Group, making us the centre of excellence for retail investments within the Group.

Our team has over two decades of experience in investment administration. Today, we’re simply bringing that expertise into a more advanced, digital-first platform designed for the future.

What is the Elevate Programme?

The Elevate programme is the systematic move of the administration of investments on the STANLIB LISP on to the INN8 Investment Platform. The move will be done over the next 12 to 18 months to enable all clients to benefit from a future-fit, digital-first investment platform. This change will not affect your existing relationship with your financial adviser, who will continue to provide excellent advice, now supported by cutting-edge technology to help you achieve your financial goals. Once the move is complete, you will interact with, and enjoy, all the benefits offered by INN8.

We are doing the move in structured tranches and have completed the first tranche successfully in May of this year. The second tranche is happening later in the year, and the final group will be moving across early next year. Advisers and clients in Tranche 2 should have already received email communication from STANLIB directly about the move. We will begin communicating with the final tranche later in the year.

Rest assured that this move will not result in any additional fees or changes to the benefits or rules of the products you are invested in and will not require paperwork or much effort on your part.

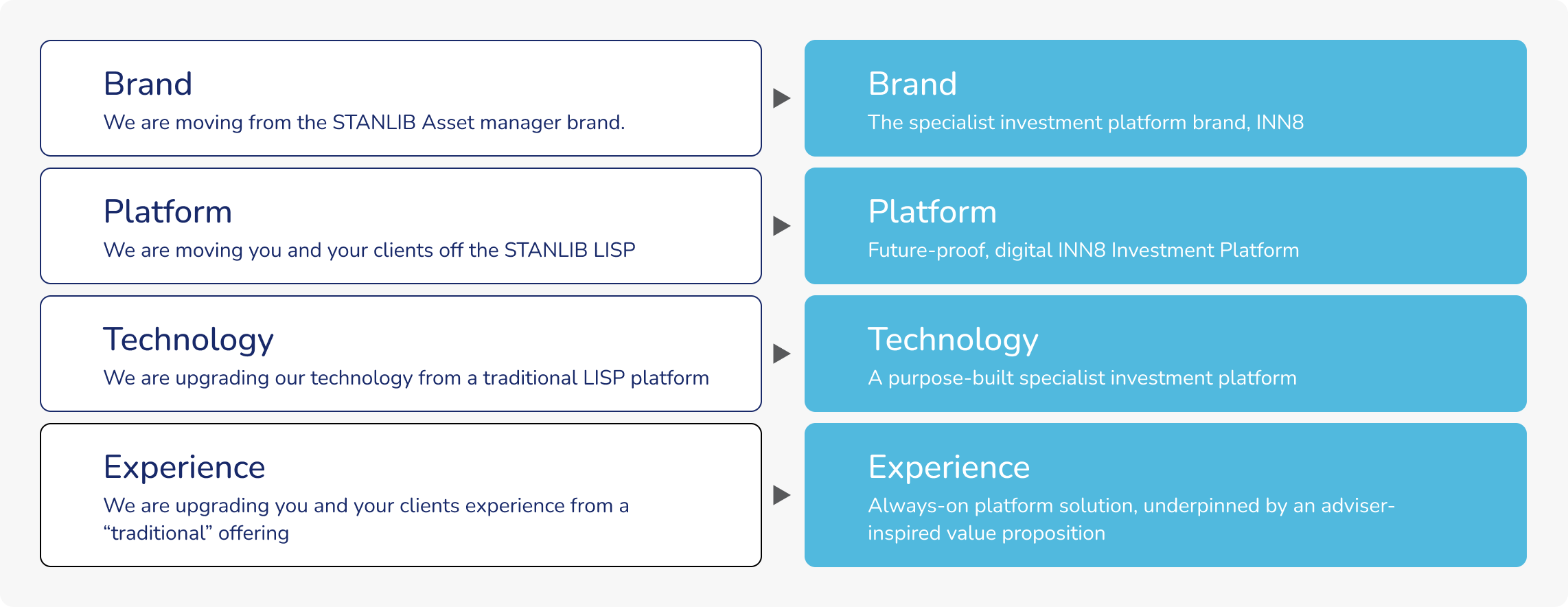

What does this mean for you?

At the heart of our new platform is a simple idea: being your adviser’s strategic partner to support you on your financial journey. This change ensures your investments are managed on a modern, secure, and efficient platform that’s built to evolve as the financial landscape does.

While moving to a new system may feel like a big step, it’s an important one, making sure your investment journey is well-positioned for the future.

What are the benefits for you?

Once you are on the platform you will be able to experience:

- Enhanced visibility:

You gain 24/7 access to their investments through the platform, providing greater control and transparency.

- Simplified tax management:

Efficient tax reporting tools help them prepare for tax season with ease and even plan proactively for Capital Gains Tax.

- Freedom of investment choice:

The platform allows you to tailor investment strategies, offering access to standalone funds, multiple model portfolios, or a combination, based on the individual goals.

- Flexibility and quick access:

You can adapt their investments swiftly to match changing financial goals, with minimal delays or restrictions on accessing their funds.

- Family linking:

You can benefit from reduced administration fees when linked family members’ investment values are aggregated

Do you need to do anything?

No, we will be communicating in due course with all clients. If you have already received communication, you were either in Tranche 1 or in the current Tranche 2. If you have not heard anything from us yet, you will be falling into the third and final tranche that will move next year in 2026.

The communication will follow this sequence:

About three months before your move, you’ll receive an introduction to this change (if you haven’t already heard about it).

Around six weeks before, we’ll confirm the steps for the move and share more information about the INN8 Investment Platform.

About a month ahead, you’ll get official notice of your exact move date.

During the move, there will be a brief period of seven working days where any transactions are paused to ensure a smooth transfer.

We’ll let you know as soon as everything is successfully moved and up and running on the new platform by sending you a Welcome Letter. This letter asks you to create a username and password to log in and activate your account. We’ve also created resources to help you through this final part of the process.

And that’s it! Then you will be in the INN8 Investment Platform world, experiencing digital-first efficiency and future-fit investment solutions in partnership with your adviser.

We have prepared a set of detailed frequently asked questions (FAQs), and have shared these with your adviser. Please contact you adviser if you would like any further information.

Let’s Elevate your financial future

Elevate is more than a platform change; it is a deliberate steptowards providing your adviser with the investment administration platform they need to support you on your financial journey.